Many are familiar with the fictional story of Jed Clampett from The Beverly Hillbillies, a 1960s American television sitcom. Jed lived the hardscrabble life of a poor mountain man in the Ozarks. One day, while hunting to provide food for his family, Jed took a shot at a rabbit, but he missed it. However, the bullet from his rifle hit the ground and struck the oil. Or, as the classic TV theme song says, “Then one day, he was shooting at some food, and up from the ground came a bubblin’ crude.” Jed had struck it rich, and he moved his family from the Ozark Mountains to Beverly Hills in California. Well, sometimes reality mirrors fiction. While it wasn’t oil that a certain baseball player found on his property, it was something that could possibly make him a billionaire. And, like Jed Clampett’s oil discovery, it was found completely by accident.

Matt White

Matt White is an erstwhile baseball pitcher. He bounced around professional baseball as a journeyman reliever, mostly in the minor leagues. He did briefly break into Major League Baseball (MLB), spending portions of three seasons with the Boston Red Sox, Seattle Mariners, and Washington Nationals. According to Baseball-Reference, he only pitched nine and two-thirds innings with an 0-2 record and a 16.76 ERA. For those not familiar with baseball statistics, let’s just say White’s numbers were… not good.

But breaking into MLB is a feat all its own. It’s estimated that less than 10% of Minor League Baseball players will ever set foot on an MLB field. So, while his MLB career was brief and lackluster, it can’t be argued that Matt White was a failure in the sport he loved. But a much greater opportunity than America’s pastime would present itself to White, and it was an opportunity that was literally right under his feet.

In 2003, White purchased a 50-acre property in the mountains of western Massachusetts. He bought the land for $50,000 from his ailing aunt, who needed the money to pay for her nursing home care.

As he was clearing a couple of acres on the property to construct a new home, White discovered some stone ledges in the ground. He decided to have the land surveyed, and the results were astonishing.

Matt White pitched briefly for three MLB teams, including the Boston Red Sox.

©4kclips/Shutterstock.com

They Found What?!?!

The geological survey revealed the ground of Matt White’s property was packed with a type of mica schist rock known as Goshen stone. It is a metamorphic rock derived from sandy mud sediments. Geologists believe the stone was formed through the intense pressure and heat that resulted when Africa and North America crashed together to create Pangaea, some 275 million years ago.

Because Goshen stone is a slabby rock, it is most often used as construction material for sidewalks, building faces, stone walls, patios, and other landscaping and gardening applications. At the time of the discovery on Matt White’s land, Goshen stone was worth $100 a ton. The survey of White’s acreage revealed an estimated 24 million tons of Goshen stone. Matt White was standing directly on top of $2.4B!

This prompted his teammates with the Red Sox to immediately tag him with the nickname “Mr. Billionaire.” But, while the source of Jed Clampett’s fortune came “a bubblin'” out of the ground, White didn’t have that luxury. The rock was certainly there, but it had to be mined. That would turn out to be quite a problem.

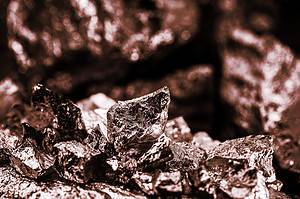

Mica schist rock is used in both construction and landscaping applications.

©Rattachon Angmanee/Shutterstock.com

Where is Goshen Stone Found?

Goshen stone is thought of as an unusual color formation of mica schist.

©Michael C. Rygel, CC BY-SA 3.0 – License

Goshen stone is found almost exclusively throughout New England, quarried in Goshen, Massachusetts, and is a type of metamorphic rock derived from sandy mud sediment. It is thought of as an unusual color formation of mica schist which enables it to be broken into long, thin sheets.

This particular stone color is not found anywhere else in the world. Mostly silver and dark grey in color, this unique, one-of-a-kind stone may also have copper, gold, and rust blended in and is an excellent material with multiple uses in landscaping, such as hearths, patios, walkways, and ponds.

Problems on Top of Problems

While he was still trying to build his pitching career, Matt White also took out loans to launch Swift River Stone Quarry. His father oversaw the new quarry business while Matt continued to focus on baseball.

White last pitched in 2010. He attempted to continue his career with the Yokohama BayStars in Japan and the Uni-President 7-Eleven Lions in Taiwan, but he was never able to make it back to MLB. That would not be the last disappointment for White, though.

The loans he had signed to launch the quarry proved too much. One of those loans shot up to a staggering 21% interest rate.

That, coupled with the hard labor required to run a two-person quarry (it was still just White and his father), was taking its own toll. White was still dealing with the effects of a shoulder injury he sustained while pitching. His father’s health was failing. He had a quadruple bypass surgery in 2008 and was simply unable to keep up the grueling pace the quarry demanded.

In 2014, it became clear there was no alternative but to declare bankruptcy. The original discovery of Goshen stone on Matt White’s property drew enormous media attention. Now, some in that same media appeared to mock him. One of the crueler headlines read, “From Mr. Billionaire to Mr. Bankrupt.”

White sold the land in 2020 for an undisclosed amount.

Matt White’s baseball days were over, but his problems were not.

©Shout It Out Design/Shutterstock.com

The Difficulties of Quarrying

Quarries, and mining in general, require high capital levels to launch. The heavy equipment and transportation costs for the mined materials also require a large and sustained investment. As a result, the first years of a quarry operation are likely to yield little to no return, with many quarries losing money in those early years.

This was the downfall of Matt White’s Swift River Stone quarry. There wasn’t enough money available above ground to get to the money that was hidden below ground.

The difficulty and sky-high quarrying costs might explain why there are less than 300 operating rock quarries in the United States today. There were far more U.S. quarries in the 19th and early 20th centuries than there are at present. Most were small and designed to serve local or regional construction projects. However, with the development of the railroad system, goods could suddenly be shipped more economically and efficiently than ever before. The smaller quarry and mining operations could not compete with larger companies that now had rail freight at their disposal.

Today, the quarrying of stone and other natural resources lies in the hands of a relative few. Smaller operations often still cannot compete with the resources of major mining companies.

Heavy machinery is just one of the huge expenses involved in operating a successful quarry.

©Juan Enrique del Barrio/Shutterstock.com

Matt White’s Story

This was Matt White’s experience. Is his a story of untapped potential, both athletically and geologically? Perhaps. He was clearly a gifted athlete and a tenacious competitor, but that potential never materialized into the long and acclaimed baseball career he had dreamt of.

And the property he purchased did indeed have incredible potential beneath the surface, but White was unable to bring it out. Yes, there were billions of dollars right under his feet. Unfortunately, that is where they were going to stay.

It all seems like untapped potential. Maybe there is a better way to see this story, though. Maybe it’s better to see the story, to borrow a baseball metaphor, as one of taking big swings.

No one could argue that Matt White didn’t pour everything he had into his baseball career. Former managers and coaches raved about his competitive mindset and his commitment to his craft. And his short baseball career did afford him the money to purchase his aunt’s property and provide her with a much-needed influx of money for her health care.

And that purchase allowed him to take another swing, this time as a quarrier. It’s about as far away from the baseball diamond as he could get, yet there he was.

Did it all work out as he expected? Unfortunately, no. He didn’t have a storied baseball career, nor did he become a quarry billionaire.

White’s potential fortune was underground, where it would sadly remain.

©larisa Stefanjuk/Shutterstock.com

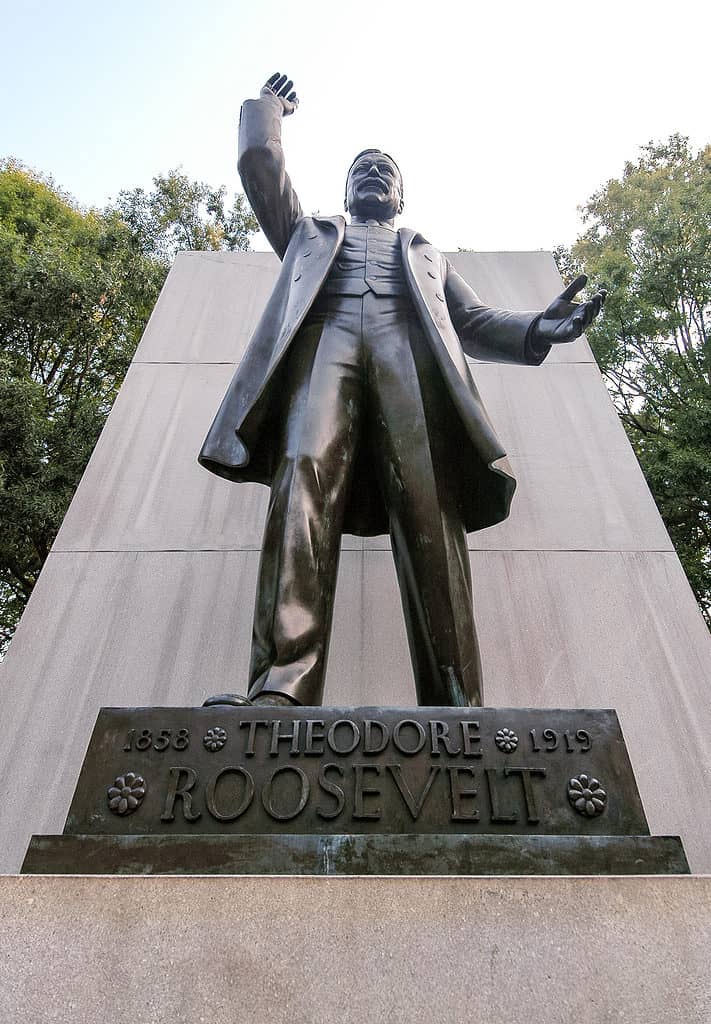

In the Arena

But a quote from a speech delivered by Teddy Roosevelt comes to mind. Roosevelt was, himself, known for taking big swings. In this particular speech, he remarked, “It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at best knows, in the end, the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither knows victory nor defeat.”

One could argue that Matt White failed, both as an athlete and a quarrier. But, unlike so many others, he never shied away from the arena. That may be his, and our, biggest success of all.

Theodore Roosevelt didn’t mince words about taking your shots.

©iStock.com/zrfphoto

The photo featured at the top of this post is © iStock.com/OlyaSolodenko

Thank you for reading! Have some feedback for us? Contact the AZ Animals editorial team.